Percentage taken from paycheck for taxes

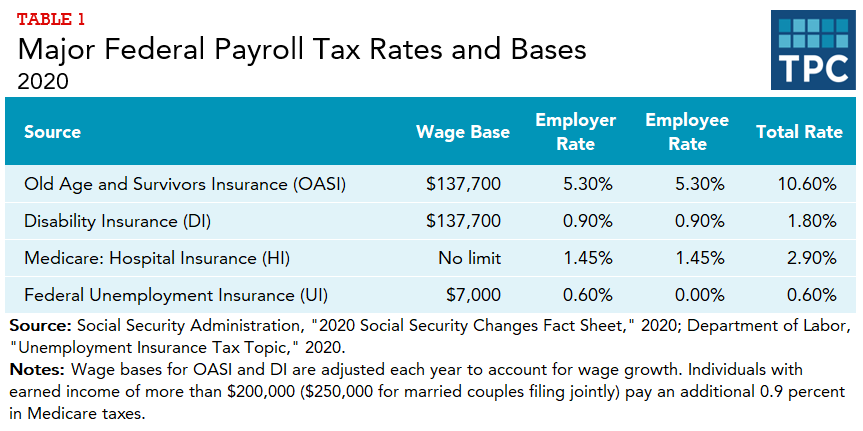

A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

The Irs Collects 3 Types Of Payroll Taxes Future Systems

The Social Security tax is 62 percent of your total pay until you reach an annual.

. The most common rate used by 20 of the 24 cities with a local income tax is 1 for residents and 05 for non-residents. Federal income taxes are paid in tiers. Ad Get the Paycheck Tools your competitors are already using - Start Now.

The amount of federal income tax. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124. Since income tax rates vary from state to state however the size of that bite will fluctuate depending on where you live.

For the 2019 tax year the maximum income amount that can be. In Tennessee for example only 1806 of your. 10 12 22 24 32 35 and 37.

This gives you your take home pay as a percentage of gross pay per pay period. In other words for every 100 you earn you actually receive 6760. You pay the tax on only the first 147000 of your.

Choose Your Paycheck Tools from the Premier Resource for Businesses. What percentage is taken out of paycheck taxes. If youre single and you live in Tennessee expect 165 of your paycheck to go.

How Your Paycheck Works. This is divided up so that both employer and employee pay 62 each. Also Know how much in taxes is taken out of my paycheck.

The employer portion is 15 percent and the. FICA taxes are commonly called the payroll tax. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. For a single filer the first 9875 you earn is taxed at 10. FICA taxes consist of Social Security and Medicare taxes.

However they dont include all taxes related to payroll. For example in the tax. Both employee and employer shares in paying these taxes.

The federal income tax has seven tax rates for 2020. 4 rows The withholding tables have tax brackets of 10 percent 12 percent 22 percent 24. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

There is a wage base limit on this tax. The percentage of your taxable income that you pay in taxes is called your effective tax rate. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. The federal withholding tax rate an employee owes depends on their income level and filing. The other 3240 is taken out.

62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. They take a big bite out of paychecks each month and just how big depends on where you live. Detroit has the highest city rate at 24 for residents and 12 for.

Federal income tax and FICA tax. The federal withholding tax has seven rates for 2021. To determine effective tax rate divide your total tax owed line 16 on Form 1040 by your total.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

Understanding Your Paycheck Credit Com

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

Paycor Infographics Payroll Tax Deductions Infographic Paycor Payroll Taxes Tax Deductions Payroll

1

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

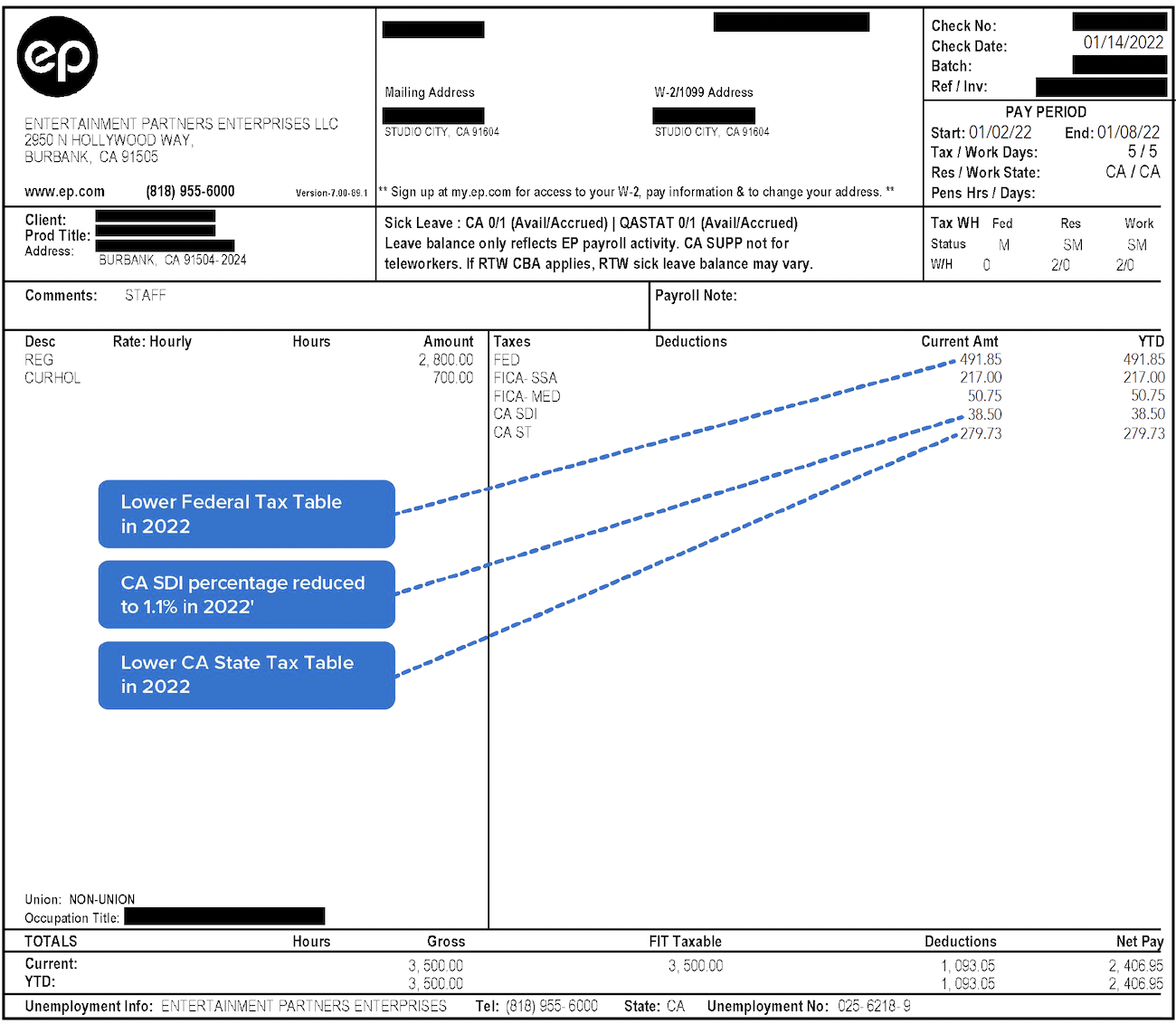

Decoding Your Paystub In 2022 Entertainment Partners

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Financial Literacy Word Wall Financial Literacy Lessons Consumer Math Financial Literacy

5 Ways To Use Your Tax Refund To Establish Financial Confidence Tax Refund Infographic Finances Money

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How To Calculate Federal Income Tax

2022 Federal State Payroll Tax Rates For Employers

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar